There’s a new mantra that seems to be sweeping the retail market, introduced by visionary brands in a desire to make a clean break from convention: ‘ultra-transparency’. A bold approach designed to appeal to customers in their search for authenticity. We took a closer look at this inspirational trend with Thierry Strickler, Retail Market Intelligence Lead at Altavia.

A new pitch: transparency

Price, practicality and accessibility are among the key factors that affect a customer’s purchasing decision, but some also look at an additional criterion that they perceive to be vital: transparency. They want to know how the product is made, where the raw materials were sourced from and the production conditions, along with the actual cost of manufacturing the product and the margin that the brand in question is making. “In an attempt to better convince and appeal to their customers, some retailers have introduced a new way of selling and doing business that focuses on transparency, or rather ultra-transparency, to be exact”, Thierry Strickler explains. “The main goal on which these brands are focusing their operations is to be able to provide evidence of the way in which their products, as ethical, responsible products that respect all of the parties involved, are manufactured and what they actually cost to make”.

DNVBs: where it all began

This concept of ultra-transparency was first introduced by DNVBs (Digital Native Vertical Brands), brands that were created online and interact with their customers.

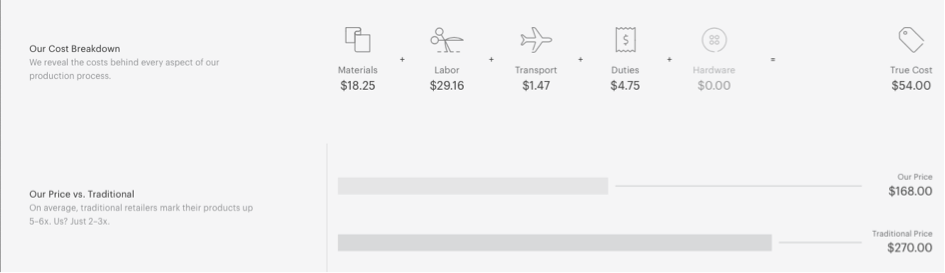

American off-the-peg fashion brand Everlane, whose slogan, “Exceptional quality. Ethical factories. Radical Transparency”, is clearly displayed on its website, was one of the pioneers of this movement. “We believe our customers have a right to know how much their clothes cost to make. We reveal the true costs behind all of our products—from materials to labor to transportation—then offer them to you, minus the traditional retail markup”, the site explains.

Maison Standards, Jules & Jenn, Léo & Violette and co.

French brand Maison Standards has adopted the same philosophy. In the words of CEO Uriel Karsenty, “we explain our methods, costs and margins and open the consumer’s eyes to the practices adopted within the industry”.

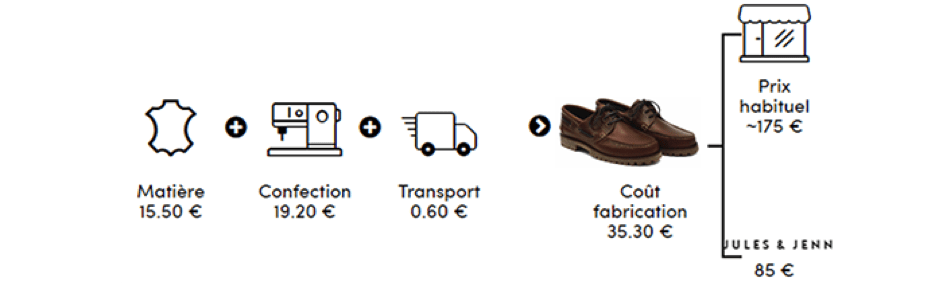

Jules & Jenn, whose slogan translates in English as “Responsible. Accessible. Essential”, also claims to “maintain complete transparency at all times”.

And here is a prime example:

“Find out why €85 is a fair price to pay for our leather cleated boat shoes”.

Léo Dominguez, co-founder of the Léo & Violette brand, meanwhile, claimed in an interview with Isal Paris that “we wanted our main focus to be on transparency. We have established a series of common values regarding the way in which we communicate and talk about our brand from the very beginning. We decided to provide place the emphasis on the manufacturing of our products and the transparency of the materials used, as well as about us as a company, showing people who Léo and Violette actually are and what we are all about. This is still true five years down the line – we still spend a lot of time explaining what goes on behind the scenes and how the brand came about. We’ve always felt that our customers appreciate this sense of proximity and this transparency with regard to our background”.

And the examples continue to multiply. Take Sephora, for example, which created a product range entitled Clean at Sephora, allowing customers to easily identify eco-friendly products that do not contain any harmful ingredients.

Boosting trust and appeal

“Unveiling your manufacturing processes and the keys to your business model are great ways to boost the appeal of and trust in your brand”, Thierry Strickler explains. “This sort of positioning enables customers looking for authenticity to choose to support a transparent, responsible and uncompromising value system, and is a great way to establish lasting, tangible links with them”.

Even those who have not (yet) adopted this philosophy of ultra-transparency have started to take note. “We are dealing with disruptive players who have the advantage of introducing a new browsing pathway that is attracting the attention of retailers”, Thierry Strickler explains. “It is safe to say that the major players in the cosmetics, food distribution, fashion and even luxury sectors are all keeping a close eye on this new model”.

This may be a bold model, but it is not without its limitations; indeed, there is no mention of design or conception, both of which are vital stages in the process and sources of added value.